A Roth IRA Vs. Traditional IRAs are both types of individual retirement accounts (IRAs) designed to help you save for retirement. The critical difference between the two is how they are taxed. Depending on your income and whether you itemize your taxes, contributions to a traditional IRA could be tax-deductible, depending on your total income and whether you have direct access to an employer-sponsored retirement plan. However, when you take funds out of a traditional IRA in retirement, you must pay taxes on the withdrawals.

On the other hand, a Roth IRA is paid for with taxed money. This means you cannot deduct your contributions on your tax return, but your money can grow tax-free in the account. When you extract money from a Roth IRA in retirement, you won’t have to pay taxes on the withdrawals as long as you meet specific requirements. Another critical difference between the two types of IRAs is that there are income limits for contributing to a Roth IRA.

What is a Roth IRA?

A Roth IRA is a specific kind of individual retirement account (IRA) designed to help you save for retirement. It is named after William Roth, who sponsored the legislation that built the Roth IRA. One of the critical features of a Roth IRA is that it is funded with after-tax dollars. This means you cannot claim a tax deduction for your contributions on your tax return. However, your money can grow tax-free in the account, and you won’t have to pay taxes on your withdrawals in retirement as long as you meet specific requirements.

Another advantage of a Roth IRA is that there are no mandatory minimum distributions (RMDs) during the original owner’s lifetime. This means you can leave your money in the account for as long as you want and then take out as much or as little as you need in retirement. There are income limits for contributing to a Roth IRA, however. You must earn more money to be eligible to contribute to a Roth IRA. Talking to a financial advisor or tax professional is a great idea to determine if a Roth IRA is right for you.

What is a Traditional IRA?

A traditional IRA is a specific type of individual retirement account (IRA) designed to help you save for retirement. It is a tax-deferred account, meaning you can claim a tax deduction for your contributions on your tax return, depending on your income and whether you have access to an employer-sponsored retirement plan. When you extract money from a traditional IRA in retirement, you must pay taxes on the withdrawals. This is because your contributions to the account were tax-deductible, so the government wants to recoup that lost tax revenue.

One of the advantages of a traditional IRA is that there are no income limits for contributing to the account. This means anyone can contribute to a traditional IRA, regardless of income. The good news is that you begin taking money out of your traditional IRA by a certain age, which is currently 72. This can be beneficial if you need to take cash out of your account to cover living expenses in retirement.

Overall, a traditional IRA can be a valuable tool for saving for retirement. However, it’s a good idea to talk to a financial advisor or tax expert to determine if a traditional IRA is right for you.

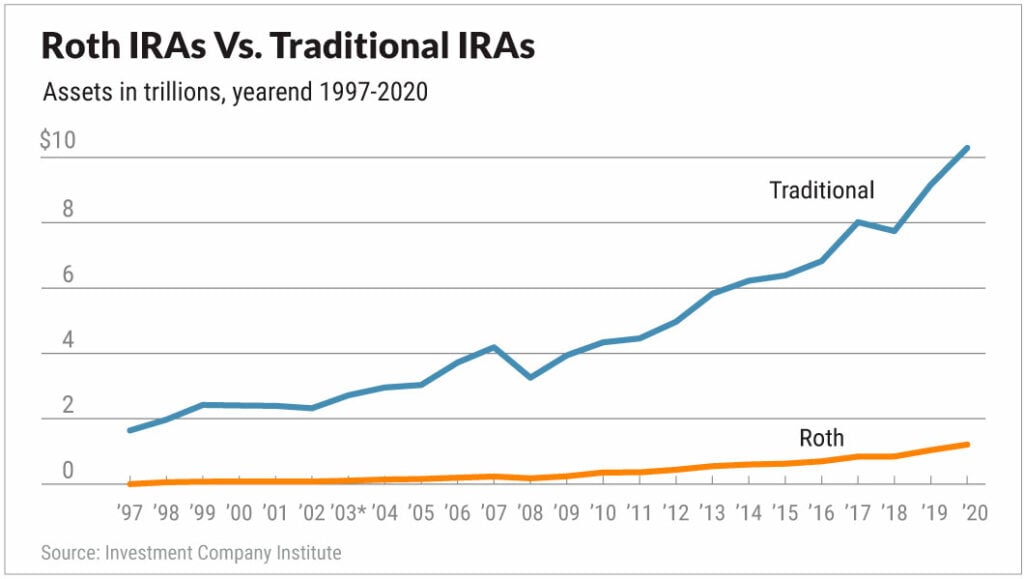

Comparing Traditional and Roth IRAs

A traditional IRA and a Roth IRA are both individual retirement accounts (IRAs) designed to help you save for retirement. The critical difference between the two is how they are taxed. Traditional IRA investments may be tax-deductible, depending on your income and whether you have access to an employer-sponsored retirement plan. However, when you take cash out of a traditional IRA in retirement, you must pay taxes on the withdrawals.

On the other hand, a Roth IRA is funded with after-tax dollars. This means you cannot deduct your contributions on your tax return, but your money can grow taxed-free in the account. When you take money out of a Roth IRA in retirement, you won’t have to pay taxes on the withdrawals as long as you meet specific requirements. Another critical difference between the two types of IRAs is that there are income limits for contributing to a Roth IRA. You may not be qualified to contribute to a Roth IRA if you generate less money. There are no income limits for contributing to a traditional IRA, however.

Overall, the choice between a Roth IRA Vs. Traditional IRAs depend on your circumstances and financial goals. It’s a good idea to speak to a financial advisor or tax professional to determine which type of IRA is right for you.

Should I Choose a Roth or a Traditional IRA?

The choice between Roth IRA Vs. Traditional IRAs depend on your circumstances and financial goals. There is no one-size-fits-all answer to this question. Below are a few things to think about when deciding which type of IRA is right for you:

- Tax benefits: Contributions to a traditional IRA may be tax-deductible, depending on your income and whether you have direct access to an employer-sponsored retirement plan. A Roth IRA is funded with after-tax dollars, so you cannot claim a tax deduction for your contributions. However, your money can grow tax-free in the account, and you won’t have to pay taxes on your withdrawals in retirement as long as you meet specific requirements.

- Income limits: There are income limits for contributing to a Roth IRA. You must earn more money to be eligible to contribute to a Roth IRA. There are no income limits for contributing to a traditional IRA, however.

- Required minimum distributions (RMDs): There are no required minimum distributions (RMDs) during the original owner’s lifetime for a Roth IRA. This means you can leave your money in the account for as long as you want and take out as much or as little as you need in retirement. On the other hand, a traditional IRA has RMDs, so you must begin taking money out of the account by a certain age.

- Age: If you are younger and have a long time horizon until retirement, a Roth IRA may be a good choice because your money can grow tax-free in the account, and you won’t have to pay taxes on your withdrawals in retirement. Suppose you are closer to retirement and need access to your money sooner. In that case, a traditional IRA may be better because you can claim a tax deduction on your contributions. You may need to take money out of the account to cover living expenses in retirement.

It’s a great idea to talk to a financial advisor or tax professional to determine which type of IRA is right for you. They can help you assess your situation and financial goals to make an informed decision.

How to Turn a Traditional IRA into a Roth

If you have a traditional IRA account and you want to convert it to a Roth IRA, there are a few steps you need to follow. Here’s an overview of the entire process:

- Open a Roth IRA account: You need to open a new account with a financial institution. You can choose the same institution that holds your traditional IRA or open a Roth IRA with another institution.

- Transfer the assets from your traditional IRA to your new Roth IRA: You can transfer the assets from your traditional IRA to your new Roth IRA in one of two ways:

- Direct transfer: This is also known as a trustee transfer. You can instruct the financial institution that holds on to your traditional IRA to transfer the assets directly to your new Roth IRA. This is the most straightforward and uncomplicated way to do a conversion.

- Indirect transfer: This is also known as a rollover. You can withdraw the assets from your traditional IRA and deposit them into your new Roth IRA within 60 days. This method may be more complicated and subject to specific tax rules and restrictions, so it’s a good idea to consult with a tax professional if you plan to do an indirect transfer.

- Pay taxes on the conversion: When you convert a traditional IRA to a Roth IRA, you will have to pay taxes on the amount you convert. This is because your contributions to your traditional IRA were tax-deductible, so the government wants to recoup that lost tax revenue. You can either pay the taxes from the funds in your traditional IRA or another source.

- Update your beneficiaries: After you convert your traditional IRA to a Roth IRA, you will want to update your beneficiaries. This ensures that your assets will be distributed to the correct person(s) after your death if anything was ever to occur.

It’s important to note that converting a traditional IRA to a Roth IRA is a significant financial decision, and it’s not suitable for everyone. There are tax implications and other factors to consider, so it’s a good idea to talk to a financial advisor or tax professional before making a decision. They can help you assess your situation and financial goals to determine if a conversion is proper for you.

Roth IRA Income Limits

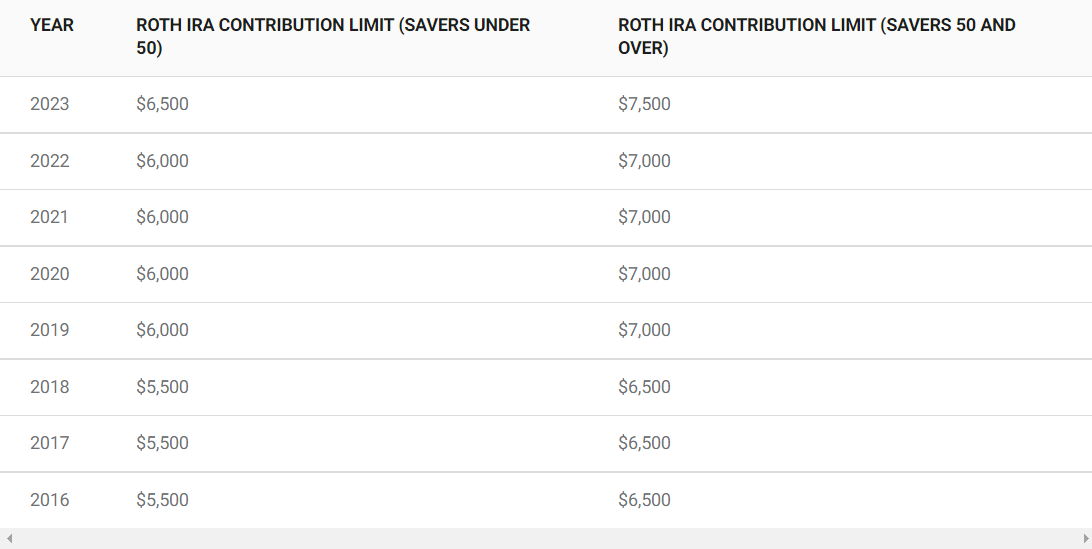

There are income limits for investing in a Roth IRA. The total you can contribute to a Roth IRA may be reduced or phased out if your income exceeds certain levels. Here are the income limits as of 2021:

- If you are currently head of household or single and your modified adjusted gross income (MAGI) is less than $125,000, you can contribute the total amount to a Roth IRA.

- Your contribution limit is reduced if your MAGI is between $125,000 and $140,000.

- If your MAGI is $140,000 or more, you cannot contribute to a Roth IRA.

- If you are currently married and filing jointly and your MAGI is less than $198,000, you can contribute the total to a Roth IRA.

- Your contribution limit is reduced if your MAGI is between $198,000 and $208,000.

- If your MAGI is $208,000 or more, you are not qualified to contribute to a Roth IRA.

It’s a good idea to check the IRS website for the most up-to-date information.

Conclusion on Roth IRA Vs. Traditional IRA

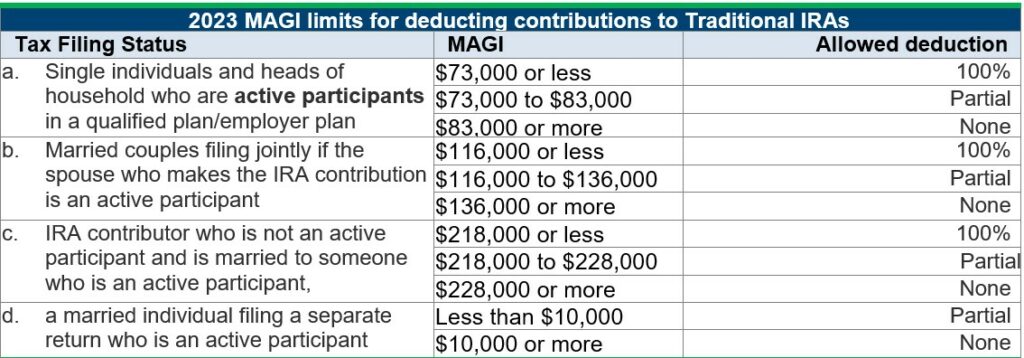

In this Roth IRA Vs. Traditional IRA, it’s important to note that these income limits only apply to Roth IRA contributions. You can still contribute to a traditional IRA, even if you are not eligible for a Roth IRA. However, you may be unable to claim a tax deduction for your traditional IRA contributions if your income is above a certain level. It’s an excellent idea to talk to a financial advisor or tax professional to determine if a Roth IRA is right for you. There are also other IRAs, such as a Gold IRA if you want to learn more. In this Gold IRA review, we offer information on the Top 6 Best Gold IRA companies accredited by the BBB with an A+ Rating.